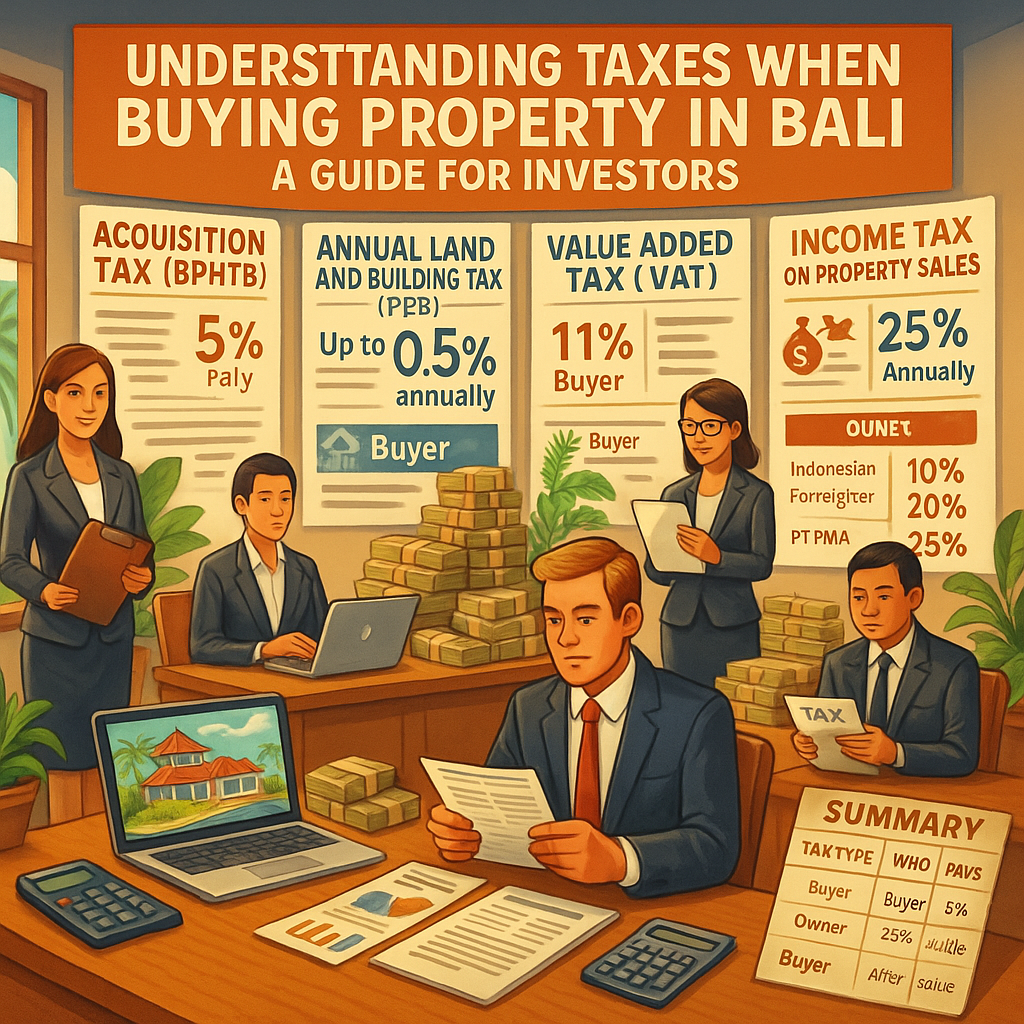

Bali continues to attract global interest as a prime destination for real estate investment. With its stunning landscapes, rich culture, and high potential for rental income, buying property in Bali can be a rewarding venture. However, navigating Indonesia's tax regulations is essential for a smooth and profitable investment experience. In this guide, we break down the key taxes you need to know when purchasing property in Bali.

1. Acquisition Tax (BPHTB - Bea Perolehan Hak atas Tanah dan Bangunan)

What it is: A one-time tax applied during the transfer of property ownership (typically for freehold transactions).

Tax Rate: 5% of the transaction value or government-assessed value (NJOP), whichever is higher.

Who Pays: The buyer.

When to Pay: After signing the sale deed (AJB) and during the ownership transfer at the land office (BPN).

Example: For a villa purchased at IDR 5 billion, BPHTB would be IDR 250 million.

2. Annual Land and Building Tax (PBB - Pajak Bumi dan Bangunan)

What it is: A recurring tax for owning land and buildings, whether residential or commercial.

Tax Rate: Up to 0.5% of the assessed property value.

Who Pays: The property owner.

When to Pay: Annually, before the deadline to avoid penalties.

3. Value Added Tax (VAT - Pajak Pertambahan Nilai / PPN)

What it is: A tax on goods and services, applicable when buying from developers or legal entities.

Tax Rate: 11% (rising to 12% in 2025).

Who Pays: The buyer (if the seller is a developer or business entity).

How it's Paid: Collected by the seller and paid to the tax office.

4. Income Tax on Property Sales (PPh Final)

Freehold Transactions

Tax Rate: 2.5% of the sale price.

Who Pays: The seller.

When to Pay: After signing the AJB and before completing the transfer with the land office.

Leasehold Transactions

Tax Rate: 10% of the total lease value and 20% if the lessor is non-Indonesian.

Who Pays: The lessor/seller.

When to Pay: At the notary signing, prior to lease registration.

Note: For foreigners leasing from locals, the tax is withheld and paid by the notary on behalf of the local party.

5. Luxury Goods Tax (PPnBM - Pajak Penjualan atas Barang Mewah)

What it is: A tax applied to luxury property transactions above a certain threshold.

Tax Rate: Typically starts at 5%.

Who Pays: The buyer.

When to Pay: At the time of purchase.

6. Rental Income Tax

What it is: Tax on income earned from leasing out property.

Tax Rates:

- Indonesian tax residents: 10% of gross rental income.

- Foreign (non-residents): 20% of gross rental income.

- Legal entities (PT PMA): 25% corporate tax on net income.

Who Pays: The property owner or entity earning rental income.

When to Pay: Annually, as part of income tax filing.

Example: For IDR 1 billion in rental income:

- Foreign investor pays IDR 200 million (20%).

- Indonesian resident pays IDR 100 million (10%).

Summary Table of Property Taxes in Bali

Tax Type

Who Pays

Rate

Timing

Acquisition Tax (BPHTB)

Buyer

5%

After sale deed, before BPN

Land & Building Tax (PBB)

Owner

Up to 0.5%

Annually

VAT (PPN)

Buyer

11% (12% in 2025)

At purchase (if from developer)

Income Tax (PPh) - Freehold

Seller

2.5%

After AJB, before BPN

Income Tax (PPh) - Leasehold

Lessor/Seller

2.5%

At lease signing

Luxury Goods Tax (PPnBM)

Buyer

Starts at 5%

At purchase

Rental Income Tax

Owner/Lessor

10-25%

Annually

Final Thoughts

Understanding the tax landscape is crucial when investing in Bali's real estate market. From acquisition duties to annual obligations and rental income taxes, being aware of these factors ensures you stay compliant and maximize your returns. At Tipi Estate, we’re here to provide clear, expert guidance every step of the way.

Looking to invest in Bali? Tipi Estate offers expert guidance and exclusive listings. Contact us today to explore your options!

Ready to make your Bali dream home a reality? Reach out to Tipi Estate for trusted real estate advice and premium properties in Bali.